News & Events

Bulletin Updates

Bulletin No.:2025-26

NRBSL Stands on the Shoulders of Giants

October 22-25, 2025

The New Rural Bank of San Leonardo (NRBSL) proudly took part in the Joint CEO Forum of the Association of Development Financing Institutions in Asia and the Pacific (ADFIAP) and the African Association of Development Financial Institutions (AADFI) held in Macau, China, on October 22-25, 2025.

Representing NRBSL, President and CEO Abundio D. Quililan, Jr. joined distinguished leaders and experts in development finance as one of the panel speakers, sharing valuable insights on the role of community-based, privately-owned, and professionally-operated small-scale banks in advancing inclusive and sustainable growth.

Mr. Quililan emphasized that institutions like NRBSL serve as vital connectors between grassroots communities and national development goals including cross-border impact investments, ensuring that financial inclusion reaches those who need it most. He underscored how local ownership and professional governance empower rural banks to deliver responsive, ethical, and impactful financial services-laying the groundwork for long-term sustainability.

As NRBSL continues to stand on the shoulders of giants, it honors and builds upon the legacy of great institutions and leaders in development finance. By participating in the event attended mostly by representatives from state-own and national-level development banks, NRBSL acknowledges that its work is strengthened by the experiences, insights, and achievements of the wider global community of development financial institutions.

In moving forward, NRBSL draws inspiration from global leaders in development finance while in its own ways reaffirming its commitment to building, resilient communities, empowering local enterprises, and shaping a more inclusive financial future.

Bulletin No.:2025-25

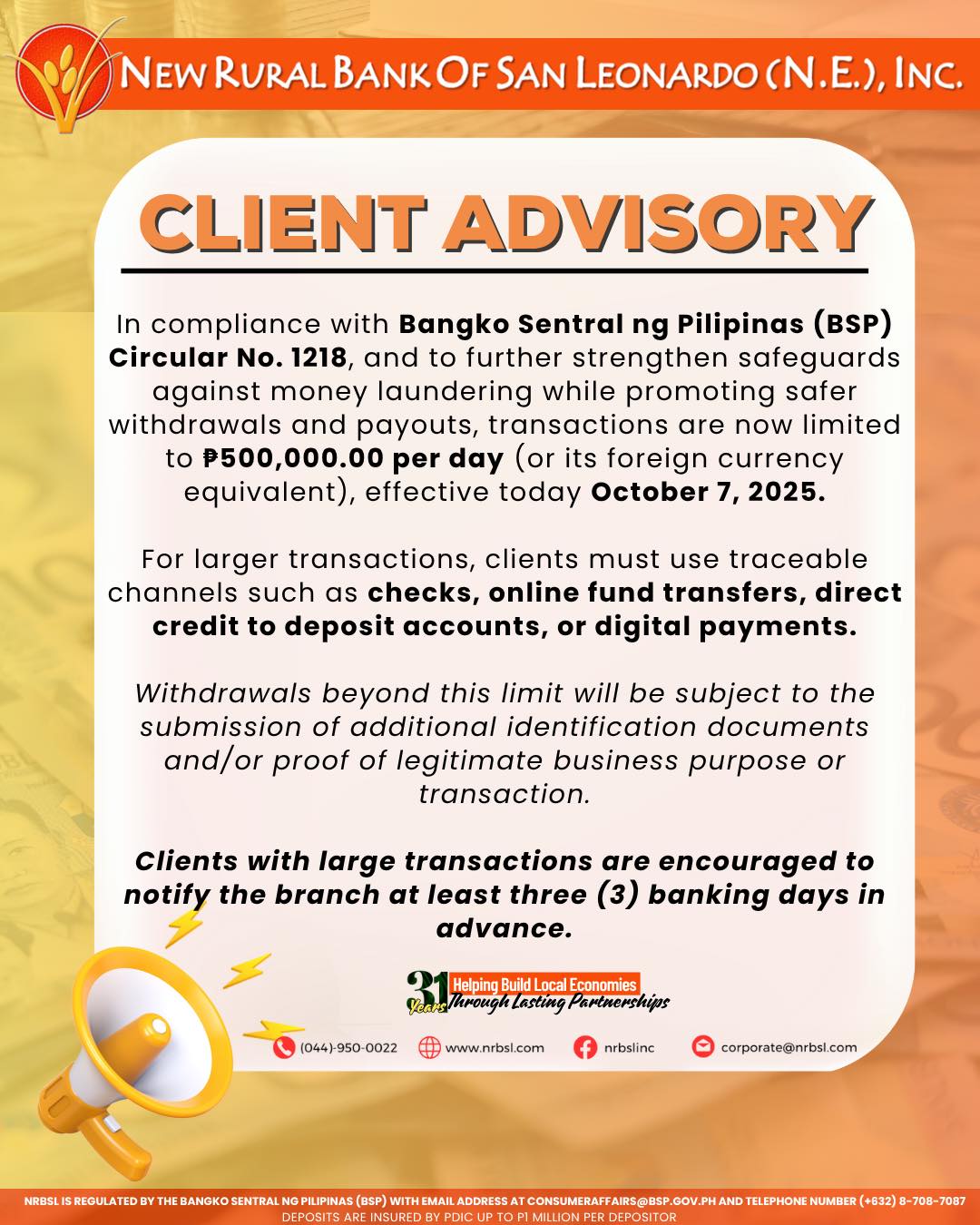

Client Advisory

October 07, 2025

The Bangko Sentral ng Pilipinas (BSP) has issued new regulations on large value cash transactions. Here's what you need to know!

Bulletin No.:2025-24

Director and VP JBB of New Rural Bank of San Leonardo (N.E.), Inc. Assumes Presidency of Confederation of Central Luzon Rural Banks for FY 2025-2026

September 15, 2025

In a significant milestone for the rural banking sector in Central Luzon, Director and Vice President Jubailene B. Bulawit of the New Rural Bank of San Leonardo (N.E.), Inc. has officially assumed the presidency of the Confederation of Central Luzon Rural Banks for Fiscal Year 2025-2026. The induction ceremony of the newly elected officers was held at the Widus Hotel, Clark Freeport, Pampanga, on Monday September 15, 2025.

Mr. Enrique I. Florencio, Secretary General of the Association of Development Financing Institutions in Asia and the Pacific (ADFIAP) grace the event as the keynote speaker and inducting officer for the event and shows support for rural banking reform and reaffirmed its central role in inclusive development.

The event was attended by representatives from 58 rural banks and officers from various federations across Central Luzon including the Board of Directors and other Members of Management Committee of NRBSL, showcasing strong solidarity and commitment to advancing financial inclusion and rural development. Also in attendance were Mr. Jose Paolo M. Palileo, President of the Rural Bankers Association of the Philippines (RBAP), and Mr. Rafael F. Amparo, RBAP Executive Director, who served as resource speakers during the event.

As the newly inducted President, Ms. Bulawit expressed her gratitude and honored to assume the Presidency from the votes of confidence from peers in the industry and the support from the illustrious line of leaders. She also underscored her administration's focus during her term "The enhancement of credit service delivery to the agriculture sector" she said. "We will tap government agencies and private institutions to assist us in the implementation of the Agriculture, Fisheries and Rural Development Financing Act of 2022 in which we are mandated to set aside at least 25% of our total loanable funds for AFRD financing'' she also added.

The New Rural Bank of San Leonardo (N.E.), Inc. takes pride in this achievement and extends its full support as she leads the Confederation through this new chapter. Again, Congratulations Ms. Jubailene Bulawit and to the rest of newly inducted officers!

Bulletin No.:2025-23

New Bank of San Leonardo (N.E.) Inc., Honored by Foundation for Sustainable Society, Inc. (FSSI) as Awardee for "Kaunlaran para sa Kapwa at Komunidad" and "3BL - People, Planet and Profit - Achievement"

September 05, 2025

The New Rural Bank of San Leonardo has proven anew its unwavering commitment to inclusive growth and sustainable development as it received FSSI's "Kaunlaran para sa Kapwa at Komunidad Social Equity and Community Development Award"and the "3BL Achievement Award". These honors, conferred by the Foundation during its 30th Anniversary at Seda Vertis North on September 5,2025.

The Social Equity and Community Development Award underscores NRBSL's ability to generate meaningful impact across multiple stakeholders. The bank has consistently demonstrated strong governance, active shareholder participation and notable contributions to communities through impactful programs and initiatives that improve the lives of marginalized groups.

NRBSL was also honored with the 3BL (People, Planet, Profit) Achievement Award, which is given to partner social enterprises that actively working towards achieving 3BL targets. This recognition affirms the bank's dedication to balancing profitability with social responsibility and environmental stewardship.

These awards stand as testaments to NRBSL's vision of being more than just a Rural bank. It is a catalyst for inclusive growth, proving that when businesses place communities at the heart of their operations, transformation is not only possible but lasting.

Congratulations to the New Rural Bank of San Leonardo for this another recognition!

Bulletin No.:2025-22

CMEPA CHECK

July 22, 2025

Let us learn together with Nardo.

Spread the fact and help others understand too.

Tandaan: Walang ibinabawas na buwis sa mismong halaga ng deposito.

The 20% final withholding tax is imposed ONLY on the interest earned by the deposit and NOT on the principal amount. The principal amount of deposit placement remains intact and unaffected by the change in tax treatment.

Learn more about CMEPA in this explainer from the Department of Finance: https://bit.ly/3IBZdEs

Bulletin No.:2025-21

LOOK: New Rural Bank of San Leonardo (N.E.) Inc. volunteers took part in an organized blood donation drive by San Leonardo Hospital and the Dr. Paulino J. Garcia Research and Medical Center on Tuesday, July 15, 2025, at Nagaño Gymnasium, Tambo Adorable, San Leonardo,Nueva Ecija.

July 15, 2025

The event brought together employees, volunteers, and community members in a shared mission to help save lives through blood donation. The New Rural Bank of San Leonardo (N.E.) Inc., actively participated in this humanitarian effort, aiming to provide a sufficient supply of blood that will surely benefit our fellow Filipinos in need.

As we support this precious and valuable activity, may it serve as a reminder and a call to everyone to take part because through donating blood, we can save lives.

We may never know who will receive our blood, but one thing is certain, where there is a life in need, there is a life we can help to save.

Bulletin No.:2025-20

IN PHOTOS | New Rural Bank of San Leonardo (N.E.), Inc. was recognized as 1st Place Top Taxpayer (Corporation Category) in the municipality of San Leonardo by the Department of Trade and Industry (DTI) and the Association of Licensing Officers - Nueva Ecija, during the MSME Week Celebration today July 11,2025 held at the NEUST Convention Center, Sumacab Este, Cabanatuan City.

July 11, 2025

Ms. Rizalinda S. Lumibao, Vice President and Key Sector Head, and Mr. Ivan Andrei R. Morada, Assistant Vice President and Head of the Branch Operations Department received the plaque of recognition on behalf of the institution.

This recognition highlights the bank's steadfast commitment to regulatory compliance, responsible corporate citizenship, and its significant contribution to local revenue generation which is vital to our community's progress, development and support local economy.

As bank celebrates its 31st founding anniversary this year, The New Rural Bank of San Leonardo (N.E) Inc., reaffirm its mission to help build local economies through lasting partnerships.

Bulletin No.:2025-19

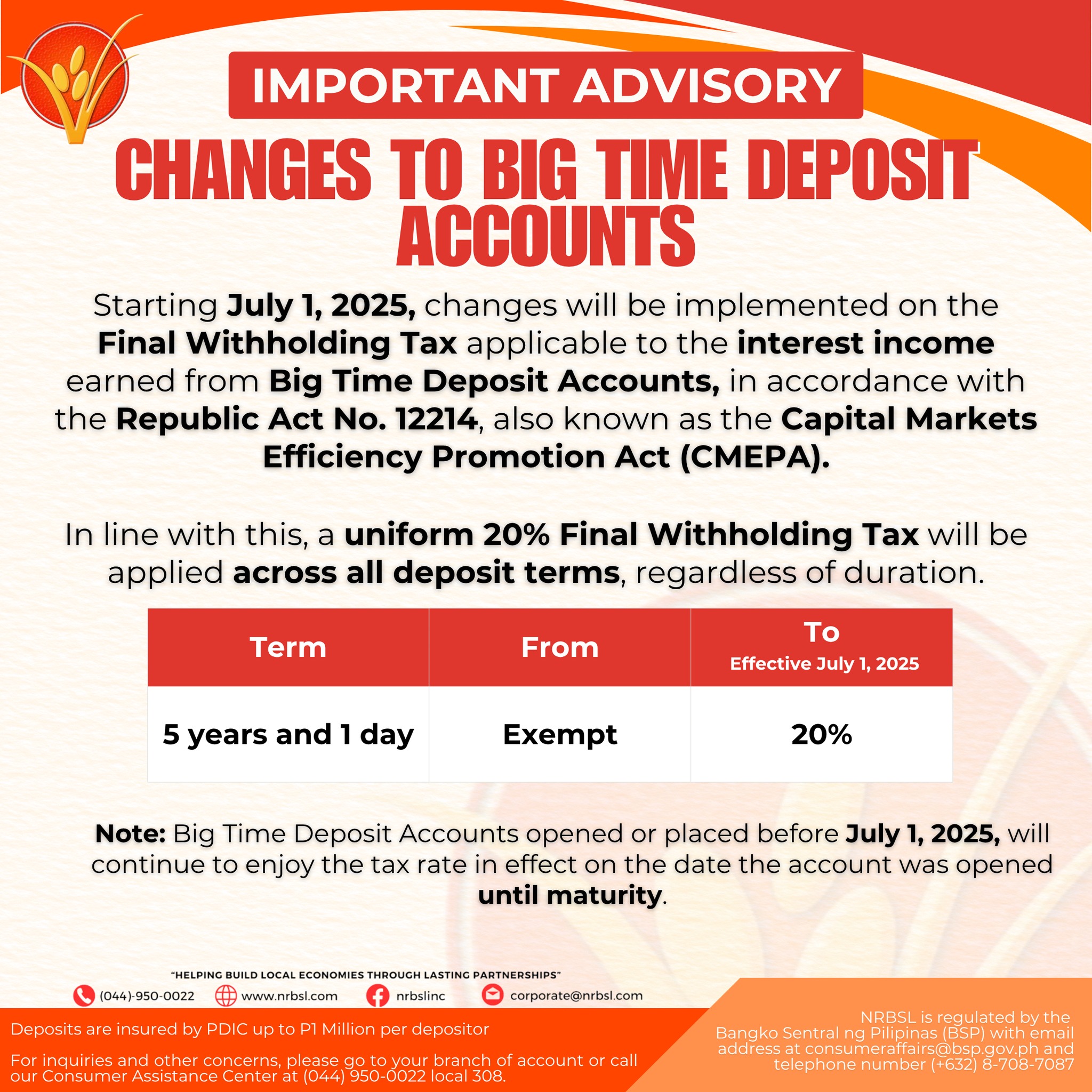

Starting July 1, 2025, changes will be implemented on the Final Withholding Tax applicable to the interest income earned from Big Time Deposit Accounts, in accordance with the Republic Act No. 12214, also known as the Capital Markets Efficiency Promotion Act (CMEPA).

July 1, 2025

In line with this, a uniform 20% Final Withholding Tax will be applied across all deposit terms, regardless of duration.

Note: Big Time Deposit Accounts opened or placed before July 1, 2025, will continue to enjoy the tax rate in effect on the date the account was opened until maturity.

Bulletin No.:2025-18

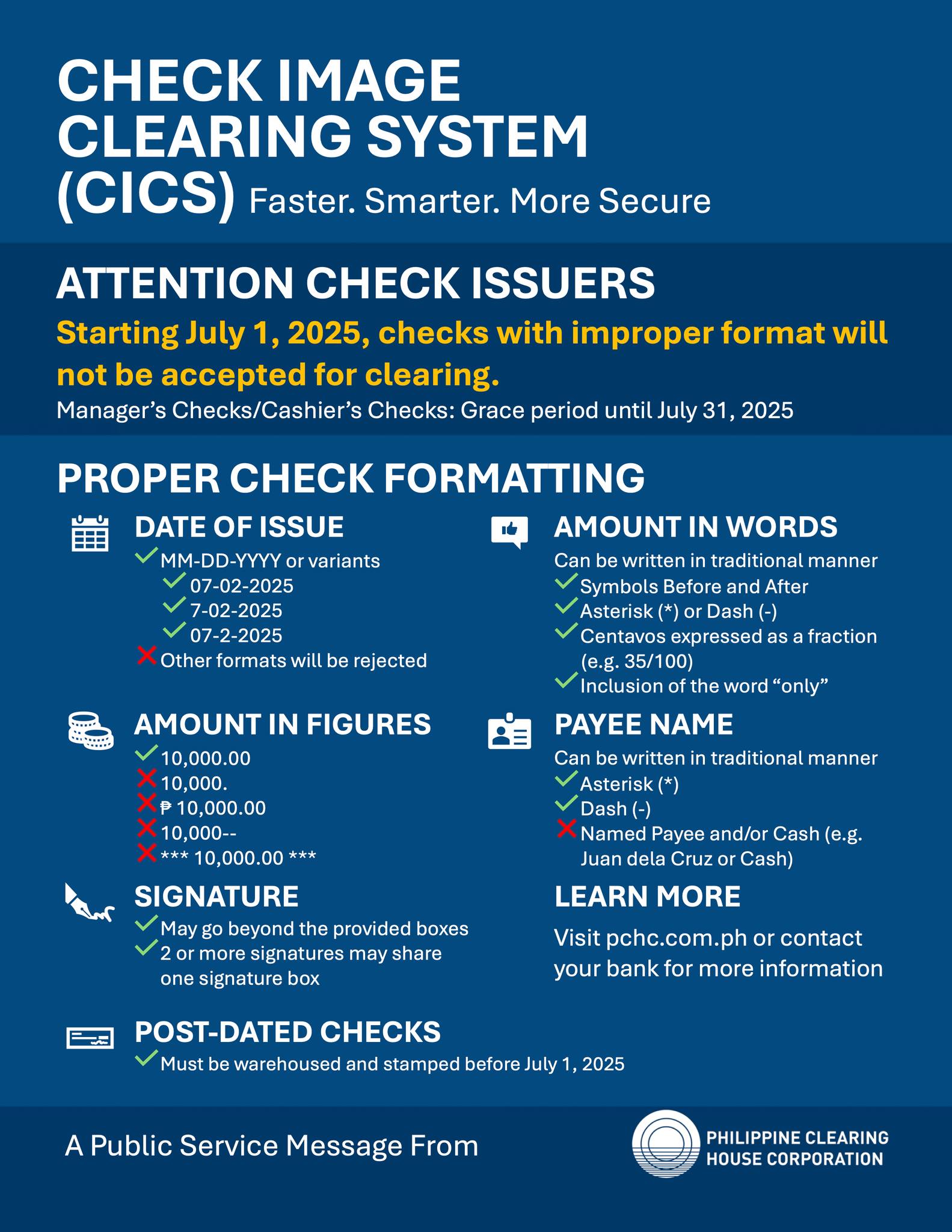

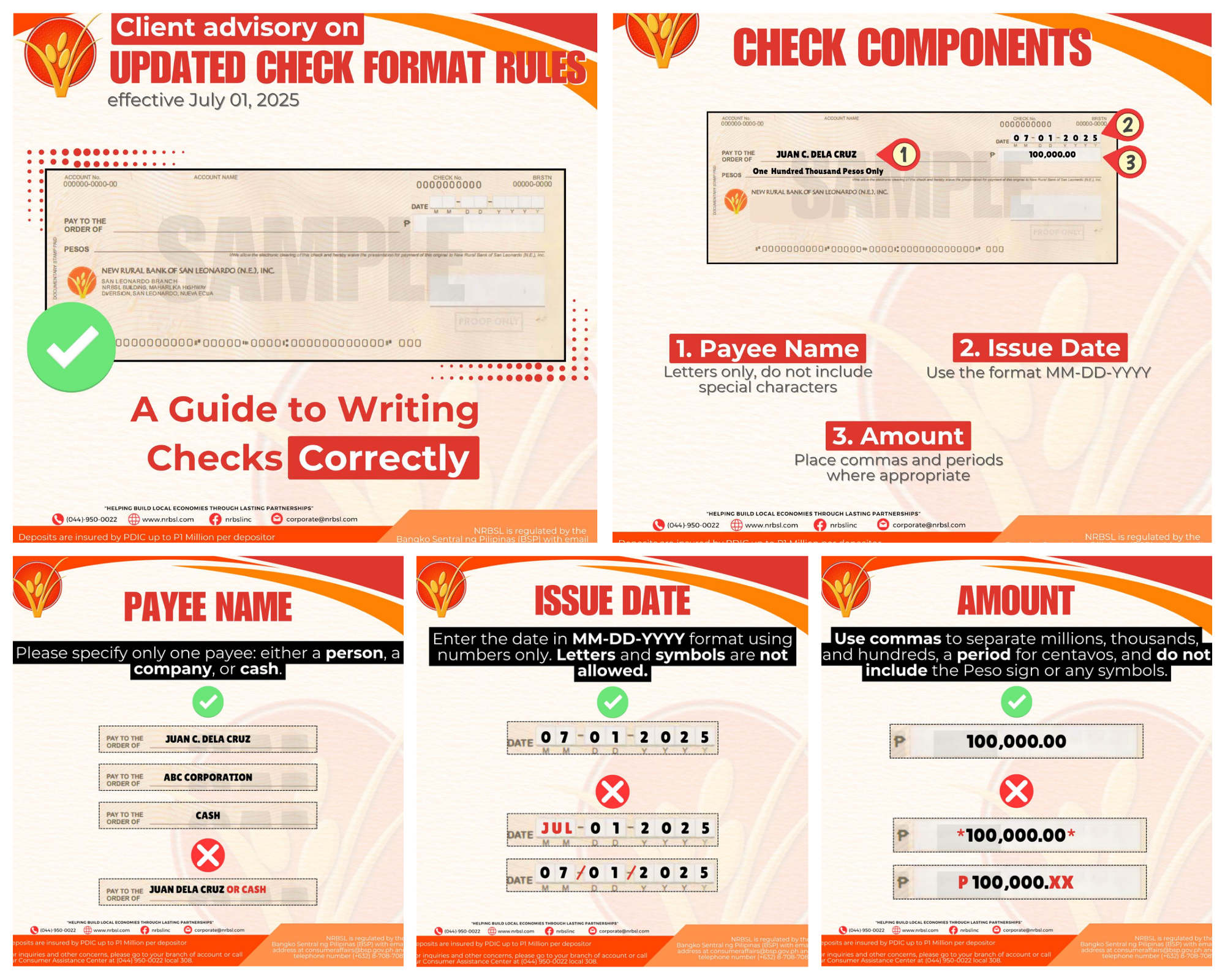

ADVISORY: Starting July 1, 2025, checks with improper formatting will no longer be accepted for clearing under the Check Image Clearing System (CICS).

July 1, 2025

To make sure your checks are processed smoothly, here's what to keep in mind:

*Use the proper date format (e.g., MM-DD-YYYY)

*Write the amount clearly in figures and words

*Indicate correct payee names

*Sign within the designated areas>

Note: For Manager's or Cashier's Checks, there's a grace period until July 31, 2025.

For post-dated checks, make sure they are warehoused and stamped ?????? ???? ?, ????.

*Pursuant to Philippine Clearing House Corporation(PCHC)

Memo Circular No. 3821

Bulletin No.:2025-17

Itinanghal na grand winner ang New Rural Bank of San Leonardo (NRBSL) sa Search for Outstanding Rural Financial Institution (Bank Category) ng 50th Gawad Saka.

June 30, 2025

Ang NRBSL, isa sa mga partner lending conduits (PLCs) ng ACPC sa Central Luzon, ay ginawaran ng nasabing parangal dahil sa kanilang kahusayan sa pagpapatupad ng mga programang pautang para sa sektor ng agrikultura at pangisdaan.

Maraming salamat sa inyong integridad, malasakit, at tapat na paglilingkod bilang isang rural bank!

Bulletin No.:2025-16

LOOK: New Rural Bank of San Leonardo (N.E.), Inc. Marks 31st Anniversary with a Eucharistic Celebration

June 27, 2025

n a heartfelt observance of its 31st founding anniversary, the New Rural Bank of San Leonardo (N.E.), Inc. held a Solemn Eucharistic Celebration on Friday, June 27, 2025, at corporate office.

The celebration was presided over by Rev. Fr. Miguel Garcia, SSS JCL, and was offered in conjunction with the Feast of the Sacred Heart of Jesus, fitting occasion symbolizing love, compassion, and dedication.

Bulletin No.:2025-15

Write Checks Correctly!

July 1, 2025

New check format rules take effect starting today, July 1, 2025.

Here's your guide to ensure smooth transactions!

Bulletin No.:2025-14

New Rural Bank of San Leonardo (N.E) Inc., named National Grand Winner for Outstanding Rural Financial Institution (Bank) during the 50th Gawad Saka: Parangal sa mga Natatanging Magsasaka at Mangingisda conferred on June 30,2025 at the Philippine Rice Research Institute in Science City of Munoz, Nueva Ecija.

June 30, 2025

Mr. Juvenal A. Moraleda Chairman of the Board of Directors together with Mr. Abundio D. Quililan Jr., President and CEO and Ms. Francisca C. Lopez, Vice President and Sector Head of Inclusive Finance Sector received the award of recognition by the Department of Agriculture and the President of the Republic of the Philippines, His Excellency President Ferdinand R. Marcos Jr.

The award recognizes the bank's unwavering commitment to inclusive rural financing, its support to farmers and fisherfolk, and its innovative strategies in empowering agricultural communities through accessible rural financial institution.

This also demonstrates that the New Rural Bank of San Leonardo (N.E.) Inc. continues to be a key partner in the nation's pursuit of sustainable agricultural growth and in reaching those in the sector who have often been left behind.

The New Rural Bank of San Leonardo will continue to extend a helping hand as a leading partner of farmers and fisherfolks.

For the community and for the Filipino people.

Bulletin No.:2025-13

New Rural Bank of San Leonardo (N.E.), Inc., Celebrating 31 Years of Service with this year's theme "Celebrating Growth, Banking on a Sustainable Tomorrow"

June 27, 2025

This year marks a remarkable 31 years of commitment in helping build local economies and providing trusted banking services through lasting partnerships.

As we celebrate this milestone, we thank you for being part of our journey - here's to a future built on strong foundations and a sustainable tomorrow.

Bulletin No.:2025-12

LOOK: New Rural Bank of San Leonardo (N.E.), Inc., Grace the street Dingalan Aurora during its 69th Founding Anniversary

June 16, 2025

The New Rural Bank of San Leonardo (N.E.), In., Dingalan Branch proudly participated in the vibrant Float Competition in celebration of the 69th Founding Anniversary of the Municipality of Dingalan, Aurora, under the theme "Dama ang Matatag na Dingalan sa Bagong Pilipinas."

Demonstrating creativity, unity, and community spirit, the bank's float wowed the community and judges and bagged an award as 2nd Placer among several impressive entries. As an active and committed community partner, the New Rural Bank of San Leonardo expressed its gratitude for the opportunity to be part of such a meaningful celebration in Dingalan Aurora.

With this , the New Rural Bank of San Leonardo (N.E) Inc., reaffirms its dedication to fostering community involvement and contributing to local traditions and celebrations.

Bulletin No.:2025-11

The New Rural Bank of San Leonardo (N.E.), Inc. Joins Brigada Eskwela 2025 Kick-Off Ceremony

June 9, 2025

The New Rural Bank of San Leonardo (N.E) Inc., joins the kick off ceremony of Brigada Eskwela 2025 with the theme "Brigada Eskwela: Sama-sama Para sa Bayang Bumabasa" at Mallorca National High School and Mallorca Elementary School last June 9, 2025.

This program marked the start of a week-long preparation of classrooms and the school for the learners, as the Department of Education formally kicks off the School Year 2025-2026. It reflects a shared commitment to provide learners with clean, safe, and functional learning spaces.

As part of its Corporate Social Responsibility (CSR), the New Rural Bank of San Leonardo (N.E) Inc., donated a two (2) sets of refurbished desktop computers to the said school, aiming to enhance the school's digital learning resources. This initiative led by the President and CEO, Mr. Abundio D. Quililan Jr. together with Senior Vice President Marcelo N. Jampil, Lord Jacob G. Aclan, Manager, Sector OIC Consumer Finance Sector, Eumer C. Aguilar, Asst. Manager - Candidate of Institutional and Community Banking Department and Jomar G. Pangilinan, HRD Officer,CSR and Sustainability Officer.

Mrs. Wilma F. Ramos, school principal of Mallorca National High School expressed her gratitude to NRBSL for donating computer to their school which is a valuable addition to their resources and for participating in Brigada Eskwela for this school year.

With this initiative, the New Rural Bank of San Leonardo (N.E) Inc., extends beyond banking, it's also about building bridges for the learners and the community. This is just the beginning, as NRBSL continues helping the future makers as well the learners toward greater heights.

Bulletin No.:2025-10

New Rural Bank of San Leonardo (N.E.), Inc., Joins the CLSU Techno Village Development Program (TVDP) Stakeholders' Summit

June 2, 2025

The New Rural Bank of San Leonardo joins the Techno Village Development Program (TVDP) Stakeholders' Summit, hosted by the Central Luzon State University (CLSU) University Extension Program Office last June 2, 2024.

This summit aimed to strengthen partnerships and celebrate collective achievements in rural development and agricultural innovation. It brought together a wide range of participants, including farmer-partners from across Nueva Ecija, model farm owners, local government representatives, and key national agencies such as the Department of Agriculture-Agricultural Training Institute (DA-ATI) Central Luzon, Nueva Ecija Provincial Agriculture Office and Key institutional partners of CLSU.

A ceremonial signing of the Memoranda of Agreement (MOA) with key stakeholders marked a significant milestone in formalizing CLSU's partnerships with Agri Ville Skills Training and Assessment Center, DA-ATI Central Luzon, the National Empowerment and Development Exchange (NEDEx), and with our institution, the New Rural Bank of San Leonardo (N.E) Inc. These partnerships are set to play a pivotal role in advancing the Techno Village Development Program's (TVDP) mission of fostering sustainable rural development through shared resources, expertise, and commitment.

Senior Vice President Marcelo N. Jampil and Vice President & Sector Head of Inclusive Finance Sector Francisca C. Lopez, represent the New Rural Bank of San Leonardo (N.E) Inc and formally signed the MOA on behalf of the institution.

READ FULL ARTICLE HERE: https://www.facebook.com/share/1AXbR3kkMq/?mibextid=wwXIfr

Photos: CLSU University Extension Program Office

Bulletin No.:2025-09

New Rural Bank of San Leonardo (N.E.), Inc. Outstanding Rural Financial Institution (Bank) (National Finalist)

May 26, 2025

Para sa mga natatanging Magsasaka at Mangingisda

Bilang bahagi ng pagdiriwang ng National Farmers' and Fisherfolks Month ngayong buwan ng Mayo, ang New Rural Bank of San Leonardo (N.E) Inc., ay binibigyang halaga ang walang sawang pagsusumikap at dedikasyon ng ating mga magsasaka at mangingisda upang matiyak ang ating seguridad sa pagkain at ang patuloy na pag-unlad ng lokal na ekonomiya.

Ang New Rural Bank of San Leonardo (N.E) Inc., ay taos-pusong nagpapasalamat sa Kagawaran ng Agrikultura (DA) sa tiwala at pagkilala bilang Outstanding Rural Financial Institution sa Gitnang Luzon na iginawad nitong ika-26 ng Mayo.

Ang parangal na ito ay isang patunay ng aming patuloy na pagsuporta at pagiging kaisa ng mga magsasaka at mangingisda sa pamamagitan ng mga serbisyong pinansyal na tumutugon sa kanilang mga pangangailangan.

Ang pagkilalang ito ay hindi lamang para sa aming institusyon kundi para rin sa lahat ng magsasaka at mangingisda na nagsisilbing haligi ng ating agrikultura. Ang kanilang dedikasyon at sakripisyo ay hindi matatawaran. Ito ay isa sa mga dahilan at nagsisilbing inspirasyon sa amin upang patuloy na maglingkod at magbigay ng mga serbisyong makikinabang ang buong komunidad. Gayundin, upang patuloy na magsisilbing katuwang sa misyong pag-abot ng masaganang bukas.

Mabuhay ang mga magsasaka at mangingisda ng Pilipinas,

Ang pagkilalang ito ay alay namin sainyo!

Bulletin No.:2025-08

IN PHOTOS: New Rural Bank of San Leonardo(N.E), Inc. Strengthens Emergency Preparedness of Employees

May 24, 2025

The New Rural Bank of San Leonardo (N.E.), Inc. successfully conducted a series of safety preparedness seminars for its employees. The event aimed to enhance awareness and preparedness in emergency situations, reinforcing the bank's commitment to employee safety and disaster readiness last May 24, 2025.

The seminar includes Fire and Earthquake Preparedness and Basic First Aid, facilitated by the Bureau of Fire Protection (BFP) of San Leonardo and Bomb Threat and Explosion Preparedness.

This initiative underscores the bank's proactive approach to ensure the safety and preparedness of its personnel in times of emergencies and also to equip participants with valuable knowledge and hands-on training on emergency response procedures.

Bulletin No.:2025-07

IN PHOTOS: NRBSL Recognized as Outstanding Financial Institution (Bank Category) at the 2025 Regional Gawad Saka Award

May 15, 2025

The New Rural Bank of San Leonardo, Inc. has been honored as the Outstanding Rural Financial Institution (Bank) during the Regional Gawad Saka 2025, held on May 15, 2025 at Subic Bay Travellers hotel, Subic, Zambales with the theme "Parangal sa Natatanging Magsasaka at Mangingisda ng Gitnang Luzon".

The Gawad Saka Awards, spearheaded by the Department of Agriculture, celebrate individuals and institutions that have made significant steps in improving agriculture and fisheries in the country. NRBSL stood out among its peers for its innovative financial services, community programs, and sustainable development initiatives designed to uplift rural areas.

President and CEO Abundio D. Quililan, Jr. accompanied by Senior Vice President and Chief of Staff, Mr. Marcelo N, Jampil together with Vice President & Sector Head of Inclusive Finance Sector Ms. Francisca C, Lopez received the award on behalf of NRBSL.

The New Rural Bank of San Leonardo ever since has been a practitioner of agricultural finance with a consistent record of over-compliance in mandated lending for agriculture. This historical performance and sustained credit exposures to agricultural producers and entrepreneurs earned BSP's accreditation as a Rural Financial Institution.

Mabuhay ang Natatanging Magsasaka at Mangingisda!

Bulletin No.:2025-06

TATLONG BANGKO AT ISANG MICROFINANCE NGO SA GITNANG LUZON, SUMALI SA BSP PISO CARAVAN

April 30, 2025

Kasali na sa Bangko Sentral ng PIlipinas (BSP) Piso Caravan ang tatlong bangko at isang microfinance non-government organization na may mga branches sa Gitnang Luzon.

Pumirma ng pledge of commitment ang New Rural Bank of San Leonardo, Masagana Rural Bank, Inc., Gateway Rural Bank, Inc., at ang microfinance NGO na Alalay sa Kaunlaran, Inc. (ASKI) upang magsagawa ng currency exchange sa ilalim ng programa.

Bukod sa Gitnang Luzon, may dalawang branches din ang New Rural Bank of San Leonardo sa Metro Manila at may 31 na branches ang ASKI sa Hilagang Luzon na kalahok sa caravan.

Layunin ng Piso Caravan na mas mapadali at mapalapit sa publiko ang pagpapapalit ng marurumi (unfit) at sira-sirang (mutilated) salapi ng bagong pera o e-money. Alinsunod ito sa BSP Clean Note and Coin Policy at Coin Recirculation Program.

Tingnan sa mga larawan ang mga bangko na nagsisilbing Currency Exchange Center, at microfinance institutions at kooperatibang lumalahok bilang Currency Exchange Partner.

Para sa BSP-supervised financial institutions na nais makibahagi sa Piso Caravan Program, makipag-ugnayan sa pinakamalapit na BSP regional office o branch sa inyong lugar. Listahan ng BSP regional offices at branches: https://bit.ly/robbsp

Bulletin No.:2025-05

New Rural Bank of San Leonardo (N.E), Inc., Participates in 48th ADFIAP Annual Meetings

April 23 to 25, 2025

IN PHOTOS: New Rural Bank of San Leonardo (N.E), Inc., Participates in 48th ADFIAP Annual Meetings in Muscat, Oman

The New Rural Bank of San Leonardo (NRBSL) proudly took part in the 48th Annual Meetings of the Association of Development Financing Institutions in Asia and the Pacific (ADFIAP), held from April 23 to 25, 2025, in Muscat, Oman.

This year's 48th ADFIAP Annual Meetings hosted graciously by the Development Bank under the theme: ''Economic Gardening and Development.'' Bringing together member-institutions in forty-two (42) countries and territories in Asia Pacific and beyond, as well as representatives from ADFIAP's global institutional partners and network. The event served as a vital platform for financial institutions and development organizations to share insights, experiences, and innovations aimed at fostering a sustainable finance ecosystem.

With pride and courage, The New Rural Bank of San Leonardo (N.E) Inc., was represented by its President and CEO, Mr. Abundio D. Quililan Jr., alongside with Vice President and Chief compliance officer Ms. Mary Joy S. Pangilinan and Assistant Vice President and Head of Banking Technology Department, Mr. Gerald Dela Cruz. Their participation underscores the bank's ongoing commitment to strengthening its role in regional development and embracing global best practices in rural banking.

Bulletin No.:2025-04

Partnership between NRBSL and Agrilever Philippines Breaks Ground in Climate-Smart Agriculture

January 8, 2025

Institutions engaged in agriculture lending had faced recurring challenges on information gaps. Personal and credit profile of farmer-borrowers; climate data and market/price indexes are not often available which affects overall risk assessment. With NRBSL-Agrilever partnership, farmers are given access to digital transformation tools that enhance both credit and farm management. The collaboration bundles NRBSL's financing program with innovative digital solutions of Agrilever that revolutionize farming methodology. Yoav Schwalb, Agrilever Board Chairman is positive that with this climate-smart approach, income sustainability for both farmers and the lender-bank will improve. He said farmers need adequate protection against multiple risk factors including adverse weather events, pest and disease outbreaks, and commodity price volatility which their technology provides. Agrilever's President Ruel Amparo said farmers will gain access to full farming protocol powered by weather intelligence and climate risk management which encompasses irrigation planning, land preparation, planting, crop care and maintenance, harvesting, drying with specific instructions when to irrigate, plant, apply inputs, spray pest control, harvest through with virtual agronomist solving any issue and provides relevant action real time, which in turn boosts the Bank's confidence to lend.

Bulletin No.:2025-03

NRBSL hosts International Study Visit on Integration of Innovative Technologies to Improve Agricultural Financing

February 20, 2025

The Asia-Pacific Rural and Agricultural Credit Association (APRACA) had chosen NRBSL anew for the Luzon leg of its study tour which include visitors from National Bank of India for Agriculture and Rural Development (NABARD), Bank of Ceylon and from other institutions Lecira Juarez, Secretary General of Asia-Pacific Rural and Agricultural Credit Association (APRACA). According to APRACA Secretary General Lecira "Bing" Juarez, the delegates wished to hear and learn both from the sides of government financial institutions and players on the ground and she could not think of a better choice than NRBSL. Senior executives of NRBSL took turns in presenting the unique perspective and practice of the Bank during the whole day activity.

Bulletin No.:2025-02

Rural Bank Officials Visit CLSU to Discuss Farmer Support Partnership

February 13, 2025

Officials from New Rural Bank of San Leonardo N.E. Inc., led by its President & Chief Executive Officer, Mr. Abundio D. Quililan Jr., along with Mr. Marcelo Jampil, Senior Vice President & Chief of Staff, Ms. Francisca Lopez, Head of Inclusive Finance, and Mr. Yernon Angeles, Inclusive Finance Agricultural Value Chain Financing Program Officer, visited the University Extension Program Office on February 13, 2025, to explore potential collaboration opportunities to support local farmers through financing options.

Mr. Quililan met with Dr. Aldrin Badua, UEPO Director, and Mr. Armando Lagasca, Head of the UEPO-Technology Promotion Division, to discuss how the bank could contribute to the Techno Village Development Program (TVDP). This initiative aims to provide farmers with affordable financing to improve their agricultural practices and productivity.

The meeting concluded with an agreement to formalize the partnership through a Memorandum of Agreement (MOA), paving the way for joint efforts to empower farmers and advance agricultural development in the region.

Written by Jon Russel E. Leal

Bulletin No.:2024-06

New Rural Bank of San Leonardo Reaches 30th Year Milestone in Reaching-out to Rural Communities

June 21, 2024

Last June 21, 2024, under the night sky of Strawberry Moon when its fullness is most visible, the New Rural Bank of San Leonardo (N.E.), Inc. held its 30th Year or "Pearl Anniversary" Celebration. The lunar occurrence is a fitting symbol to mark the transition of NRBSL from its fresh beginnings in 1994 to a state of growth thirty years after. This feat is deeply meaningful as another major milestone is reached in the Bank's continuing journey and another chapter is commenced in its development path.

As he addressed the collective of 200-strong NRBSL's expanded family, the Bank's Chairperson Juvenal Moraleda remembered and paid tribute "to the men and women who have the foresight, the imagination, and the courage to venture into what is now the new Rural Bank of San Leonardo from practically nothing". He honored the memory of those "who have already gone ahead of us to receive their reward, Bishop Julio Labayen, Bishop Leverne Mercado, and our own beloved, Andres 'Boypee' Panganiban, to name only a few and to draw inspiration, commitment, and strength from their indomitable spirit to help us in our work in the future."

The event bannered NRBSL's enduring catch-phrase "Helping Build Local Economies Through Lasting Partnerships" which was matched by a colorful anniversary logo that artistically illustrates the diverse business portfolio of the Bank and the principles of sustainability and inclusive growth that it stands for. Now with 25 full-service branches across five provinces in Central Luzon including presence Metro Manila, the Bank is proud that it has come this far. To its leadership though, it is not just the years in the life of the institution that matter but it is the lives of thousands it touched with the majority from the ranks of small farmers and the productive collaborations it forged that count most. To its valued and loyal clients, NRBSL dedicates this achievement, on the other hand the Bank deeply appreciates the trust and support of its ever-dependable partners.

As an expression of friendship and solidarity, video recording from NRBSL's long-time patrons were shown which include messages from Michael de Jesus, President and CEO of Development Bank of the Philippines (DBP); Ma. Celeste A. Burgos, Executive Vice President of Land Bank of the Philippines (LBP); Jocelyn Alma R. Badiola, Executive Director of Agricultural Credit and Policy Council (ACPC) and Atty. Emmanuel R. Torres, Senior Vice President of Philippine Guarantee Corporation (PhilGuarantee). The guests were led by NRBSL Director John Mark Cajiuat in the toast to honor the shared advocacies on rural development and the fruitful years of relationship.

Among the highlights of the gathering is the awarding of Plaque of Service Milestones and cash gifts to show that in NRBSL the deserving and committed personnel are rewarded and the rest are inspired to demonstrate the same loyalty and work efficiency. Appliances and other items were given away to ensure that each employee present won a raffle prize.

The long-gown and coat-and-tie affair, accentuated by the creative styling of the venue inside Nagano Gym in San Leonardo, Nueva Ecija, and complete with video screens, photo wall, rotating photo booth and other effects, is a fitting vibe for the elegant formal event. To the delight and enjoyment of everyone, cocktails and catered gourmet food was served and mobile liquor bar was set-up. The attendees regardless of position in the organization, experienced fine dining with soothing instrumental music played live by a violinist and saxophone artist. The anniversary ball was not complete without the performances and the choice of the stars of the night.

The anniversary celebration was described by Mr. Abundio D. Quililan, Jr., a pioneer employee who rose to the position of President, "as a meaningful occasion to reflect about the past 30 years of NRBSL and its humble beginnings. It is also a time to rejoice and be glad about the Bank's accomplishments in development finance. More so, it is a moment for the members of the organization particularly the leadership to re-affirm the same commitment to continue NRBSL's time-honored advocacies."

Bulletin No.:2024-02

Delegates from NRBSL attend the 47th Annual Meetings the Association of Development Finance Institutions in Asia and Pacific (ADFIAP)

The New Rural Bank of San Leonardo continues to live up to its strategy of partnership, networking and collaboration work. Last May 15-17, 2024, at the Sofitel Phnom Penh Phokeethra, Phnom Penh, Cambodia, NRBSL took part in the 47th Annual Meetings the Association of Development Finance Institutions in Asia and Pacific (ADFIAP). A five-person delegation from the Bank's governing Board - John Mark Cajiuat, Magdalena G. Fernandez, Marcelo N. Jampil, Jubailene B. Bulawit and Abundio D. Quililan, Jr., represented NRBSL in this international gathering.

Set against the backdrop of a rapidly changing global climate landscape, this year's theme, "DFIs Role in Sustainable Finance Ecosystem: Cultivating a Climate-Smart and Sustainable Future," underscores the pivotal role that Development Financing Institutions (DFIs) play in fostering environmental responsibility and long-term financial stability. The event gathered together executives from the leading development finance institutions in the Asia-Pacific region including other stakeholders. They dwelled on pressing issues and explored innovative solutions in the practice of sustainable finance. The call and challenge according to Enrique I. Florencio, ADFIAP Secretary General, is for DFIs to take a proactive stance in shaping a sustainable financial ecosystem. Indeed so, the gathering had facilitated meaningful discussions on how various initiatives contribute to a climate-smart and sustainable future through panel discussions and delegates-meet-delegates sessions.

NRBSL President and CEO Abundio D. Quililan, Jr. were among the presentors who took turns in addressing a broad spectrum of topics which included green finance, climate risk management, and fintech innovations. NRBSL's membership with ADFIAP was not out of the Bank's own initiation but was a result of an endorsement from the former President of Development of the Bank President (DBP) Manny Herbosa who previously held key position in the Association. This is not surprising as ADFIAP's roster of member-institutions is filled mostly by government-owned banks and entities directly funded by them or assisted by aid agencies. The Philippine representation includes LBP, DBP and SB Corporation from the government side. Also in the short list are CARD and ASKI coming from the sector of MFIs while Esquire Corporation is a private financing company. NRBSL, on the other hand, is capitalized by private equity and supervised by monetary authorities without any distinction much less preference against the larger members of the financial sector. These characteristics make NRBSL's case unique and untypical relative to the profile and composition of ADFIAP's general assembly.

The majority of ADFIAP's member-institutions are funded by their respective government while private initiatives are mostly large corporation or MFIs which are capitalized by business entities or supported by grant funds. NRBSL lacks any of these attributes. Nonetheless, the participation of NRBSL in the recent ADFIAP's General Assembly served as a window for the Bank to look for insights from the international financial environment. It is not a way to measure-up but to have a glimpse on how it can scale-up its operations with the current trends in development finance.

The experience in attending events such as ADFIAP's is supposed to instill criticality among the members of NRBSL organization to observe not only the structural trends happening but to see the factors behind the success others have achieved are traced in initiating concrete actions individually and collectively. These structural trends that drive many of these changes in the financial environment are a rich source of blueprints of a broad range of activities that NRBSL can adopt in its continuing journey into the future of development finance.

Bulletin No.:2022-08

Cropital and NRBSL ink Engagement on Credit Scoring Solution

Cropital is a crowd-funding platform that connects anyone to help finance farmers. The company receives support from institutions in the U.S.A, Netherlands, Malaysia, and the Philippines. Aside from its activities as a social enterprise which provides farmers access to scalable and sustainable financing, Cropital offers credit scoring application which NRBSL has outsourced to improve its credit granting methodology in servicing small farmers. Through an official agreement, the parties have formalized this pilot endeavor in the industry of rural banking particularly in the service of small agricultural finance.

Bulletin No.:2022-07

NRBSL joins ADFIAP and wins awards

Through the encouragement of President Emmanuel Herbosa of the Development Bank of the Philippines (DBP), NRBSL became the newest member from the Philippines of the Association of Development Financing Institutions in Asia and the Pacific (ADFIAP). During its 45th Annual Meetings held in Konrad Hotel Manila on October 26, 2022, ADFIAP welcome NRBSL in the roster of 120 member-institutions engaged in the financing of sustainable development initiatives in 42 countries and territories in Asia and the Pacific. Not to be outdone by bigger organizations, NRBSL submitted two projects as entries in as many categories and won in both fields. NRBSL was adjudged as WINNER - Category 7, Local Economic Development for its project: "Collaboration Work in Agriculture Supply Chain Eco-System“ and as MERIT AWARDEE - Category 8, Financial Inclusion, for its product "Credit Facilities for the Acquisition of Residential and Commercial Properties in favor of Asset-less Rural Households and Small Enterprises through Land Partitioning/Individual Titling and Usufruct Rights”.

Bulletin No.:2022-06

NRBSL supports Philippine Red Cross as Fund and Blood Donor

After two years, the New Rural Bank of San Leonardo (N.E.), Inc. once again conducted its annual blood-letting activity with a tag line “Donate Blood, Save Lives”. The event was facilitated by Philippine Red Cross Bulacan Chapter. Ricardo A. Villacorte who was once a branch manager of NRBSL and now PRC Bulacan Chapter head led his team of volunteers to administer blood extraction among NRBSL personnel including relatives and friends last September 10, 2022 at the bank’s Training Room NRBSL Bldg. Diversion San Leonardo Nueva Ecija. The said activity becomes successful with a total of 43 successful donors.

Bulletin No.:2022-05

Clean and Green Campaign Launched in line with Sustainable Banking

With the theme “Promoting Health and Cleanliness in the Workplace”, NRBSL launched last August 12, 2022 a bank-wide campaign to promote clean and green working environment. The launching coincided with simultaneous beautification activities in all 24 branch offices of the Bank with an overwhelming participation of employees who acknowledge that keeping work areas conducive and clean is essential for business, health and the environment. More of these activities are expected in the future to promote environmental consciousness and climate change education among bank personnel. The campaign is intended to generate greater momentum in advancing NRBSL’s sustainability goals. Members of NRBSL organization are called to make individual efforts to practice reduce, reuse and recycle in the office and at home as part of overall strategies towards the adoption of sustainability principles in the business model and operations of NRBSL. The ultimate aim is to embed sustainability principles not only in the bank’s business portfolio but to make these as part of the code of how NRBSL as an institution is governed and in the manner work functions in the bank is discharged by members of its organization.

Bulletin No.:2022-04

ADFIAP serves NRBSL request for sustainability reporting briefing

Posted by: ADFIAP on 30 June 2022

ADFIAP’s Secretary-General, Mr. Enrique Florencio, briefed the Bank’s key officers virtually on June 30, 2022, on recent trends in international business reporting using the Global Reporting Initiative (GRI) framework and its guidelines, and on the processes in preparing such a report, at the request of the Nueva Ecija-based member, New Rural Bank of San Leonardo.

As part of its ongoing efforts to strengthen its internal management systems and reporting process, NRBSL https://www.nrbsl.com/ intends to publish its first annual and sustainability report in order to convey its performance to its stakeholders in a comprehensive manner. Through its famed “Lima Para sa Lahat” Program, which was memorialized in Mr. Panganiban’s book “Barefoot Banking,” NRBSL pioneered modern-day microfinance operations in the province. In the years thereafter, the bank has redefined its market niche in serving small farming communities by partnering with the government’s lending program and pushing for the conversion of micro-enterprises to SME status.

Since then, the ADFIAP Secretariat in Manila has briefed and advised members on the drafting of their sustainability reports. If you require guidance or assistance in preparing your sustainability report, please contact your Secretariat at inquiries@adfiap.org.

Bulletin No.:2022-03

NRBSL supports Philippine Red Cross as Fund and Blood Donor

A delegation from Philippine Red Cross Bulacan Chapter headed by its Governor and Bulacan 3rd District Representative Lorna Silverio and Chapter head Ricardo A. Villacorte met with executive officers of NRBSL during a visit at its Corporate Office last June 21, 2022. The occasion was a pleasant exchange of updates from both organizations about the various initiatives in their respective areas. Also discussed is the resumption of blood-letting activity involving the members of NRBSL organization. The meeting was capped with the hand-over of the P50,000 donation from NRBSL in favor of PRC to the delight of the visitors who acknowledged the generosity of the Bank.

Bulletin No.:2022-02

NRBSL bags another “Gawad Lingap Award” as Outstanding Lending Conduit of Agricultural Credit and Policy Council (ACPC)for 2022

In a ceremony held at Novotel in Araneta Center, Cubao, Quezon City on April 28, 2022, NRBSL’s President and CEO Abundio D. Quililan, Jr. accompanied by Vice President for Marketing Liza J. Ison received the trophy from Monetary Board member Bruce Tolentino and Department of Agriculture Undersecretary Evelyn Laviña. This is the second time in a row that NRBSL won this award from ACPC which organized the event after a two year break. The first time was during the first ever Gawad Lingap Award in 2019 when NRBSL was named as Outstanding Lending Partner in the implementation of Production Loan Easy Access (PLEA) Program. These awards are testaments that NRBSL is true to its mission as rural bank in servicing the credit needs of small farming communities through on-boarding with government credit programs.

Bulletin No.:2022-01

Carapreneurs receive PHP4.6 million-worth of loan under DA-ACPC-ANYO Program

Published by Philippine Carabao Center, November 4, 2021

Written by: Dine Yve Daganos

With the endorsement of Department of Agriculture-Philippine Carabao Center (DA-PCC), 38 carapreneurs from Nueva Ecija were formally granted a total of PHP4,617,000 worth of loan by the New Rural Bank of San Leonardo (NRBSL) Incorporated, Nueva Ecija, under the DA-Agricultural Credit Policy Council (ACPC) Agri-Negosyo Loan Program (ANYO).

The ceremonial turn-over, which happened during the 7th National Carabao Conference closing program, was graced by Abundio Quililan Jr., NRBSL President and Chief Executive Officer, and DA-PCC OIC Executive Director Dr. Ronnie D. Domingo and few carapreneurs who were able to attend the event physically.

The loan will be used purposively for purchase of additional numbers of carabao as well as improvement of carabao pen and other incidental or miscellaneous expenses. The loan proceeds will be released directly to the supplier of carabao and/or source of construction materials except for the miscellaneous/incidental expenses which will be received in cash by the carapreneur beneficiaries.

The DA-ACPC ANYO Program is a zero-interest capital loan intended to support the daily business operations of small farmers and fisherfolk, farmers’ cooperatives and associations (FCAs), and agri-fishery-based micro and small enterprises (MSEs).

Effective 15 September 2021, NRBSL will be accepting interbranch CASH Deposit Transactions for a minimal fee, as follows: