Products

Uniquely NRBSL is a line-up of products and services that revolve around supporting and addressing its goals and principles, with specific eye for innovation. Overall, the portfolio mix of NRBSL is a demonstration of its mission to increase the capacities of the rural areas; cause the transformation of small farmers and entrepreneurs; make house financing available self-employed individuals and support socially relevant projects. These sectors comprise the focus of NRBSL’s business model which is directly aligned with its social mission. This portfolio development perspective resulted from the Bank’s medium-term strategic direction it has pursued over the years. The product lines and programs that capacitate these sectors are being consistently reviewed and re-designed to achieve the social and business goals of the Bank.

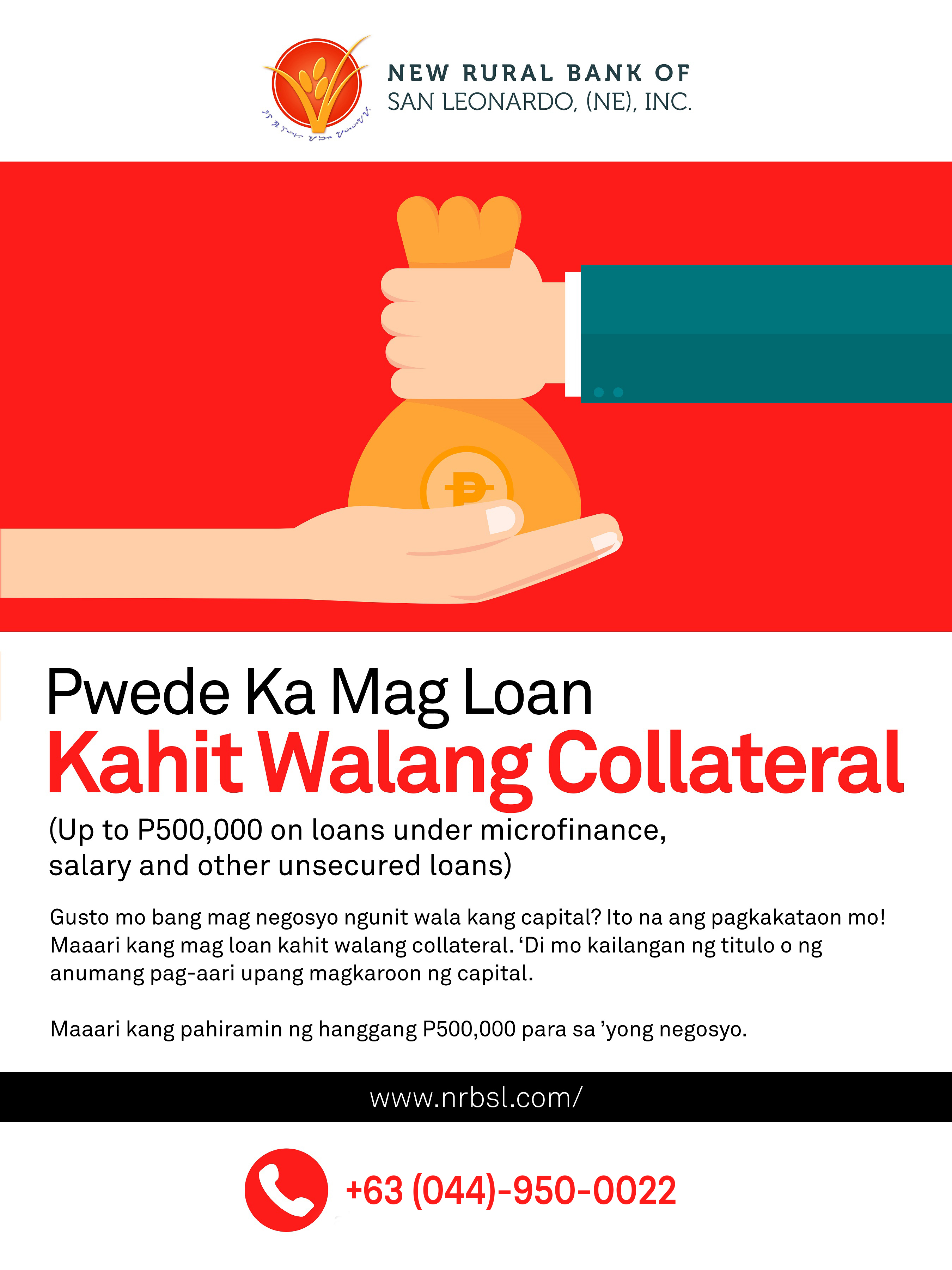

Loans

|

|

|

|

|

|

|

|

|

|